Diving into our notes from the most recent cycle of economic forecasts and annual meetings, one takeaway stood out from the rest: in a more competitive rental market, the key to improving leasing performance is to operate better. This is a pivot from the efficiency-forward approach that gave lean operators a strategic advantage.

Operating better begins with an improved understanding of the modern renter. Who is the modern renter? What drives their decision making? These questions should be at the core of marketing and operations strategy for multifamily.

For Modern Renters, Affordability is Top of Mind

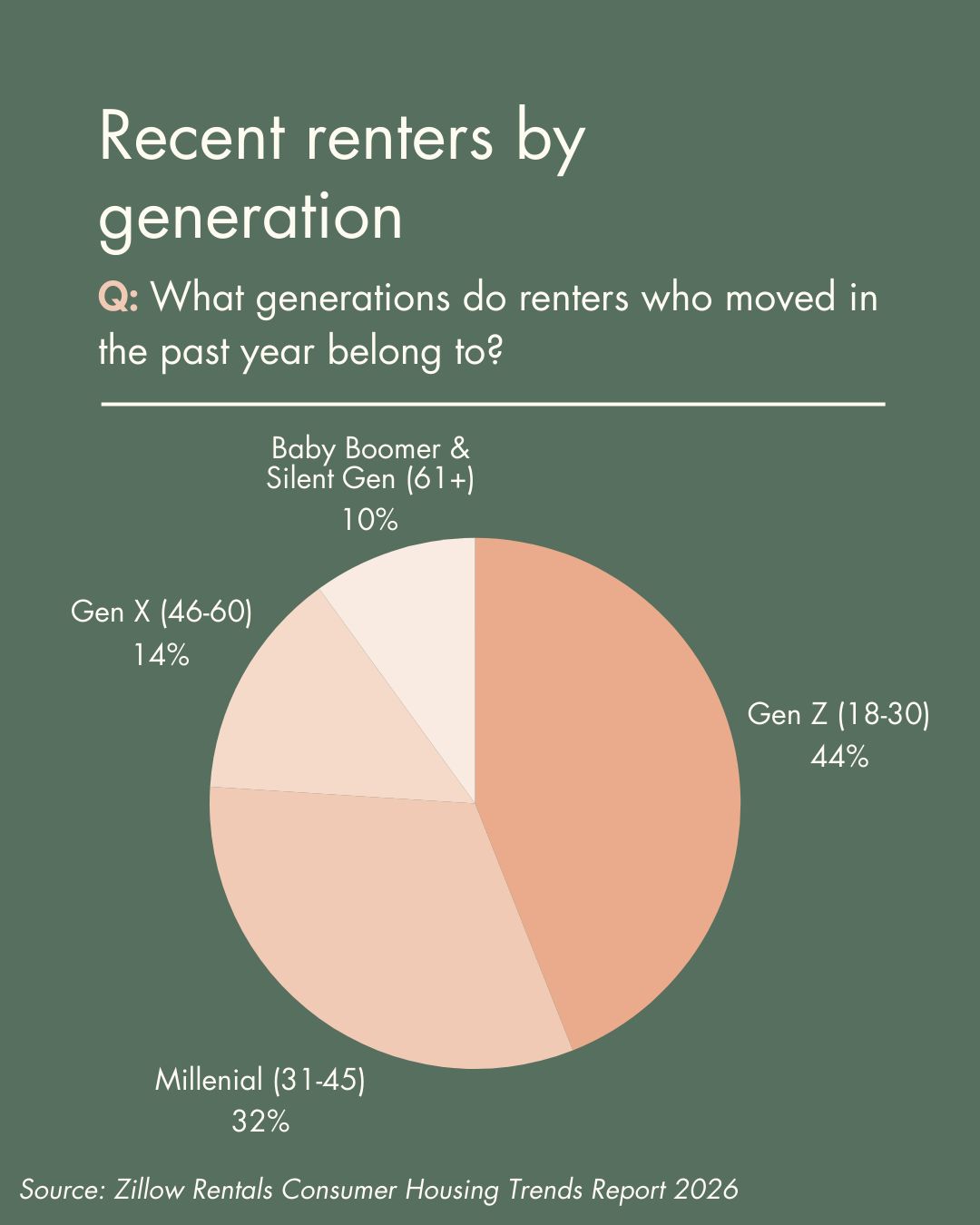

Accounting for 44% of recent renters, Generation Z has become the largest age demographic for new rental prospects. While Gen Z has increased their share of the rental market, they’ve moved slower than previous generations because of economic restrictions. 3/5 of Gen Zers are considered rent-burdened, spending at least 30% of their income on rent, and unemployment is over 10% for young adults. For multifamily, this means a significant portion of the available market lacks the economic stability to lease.

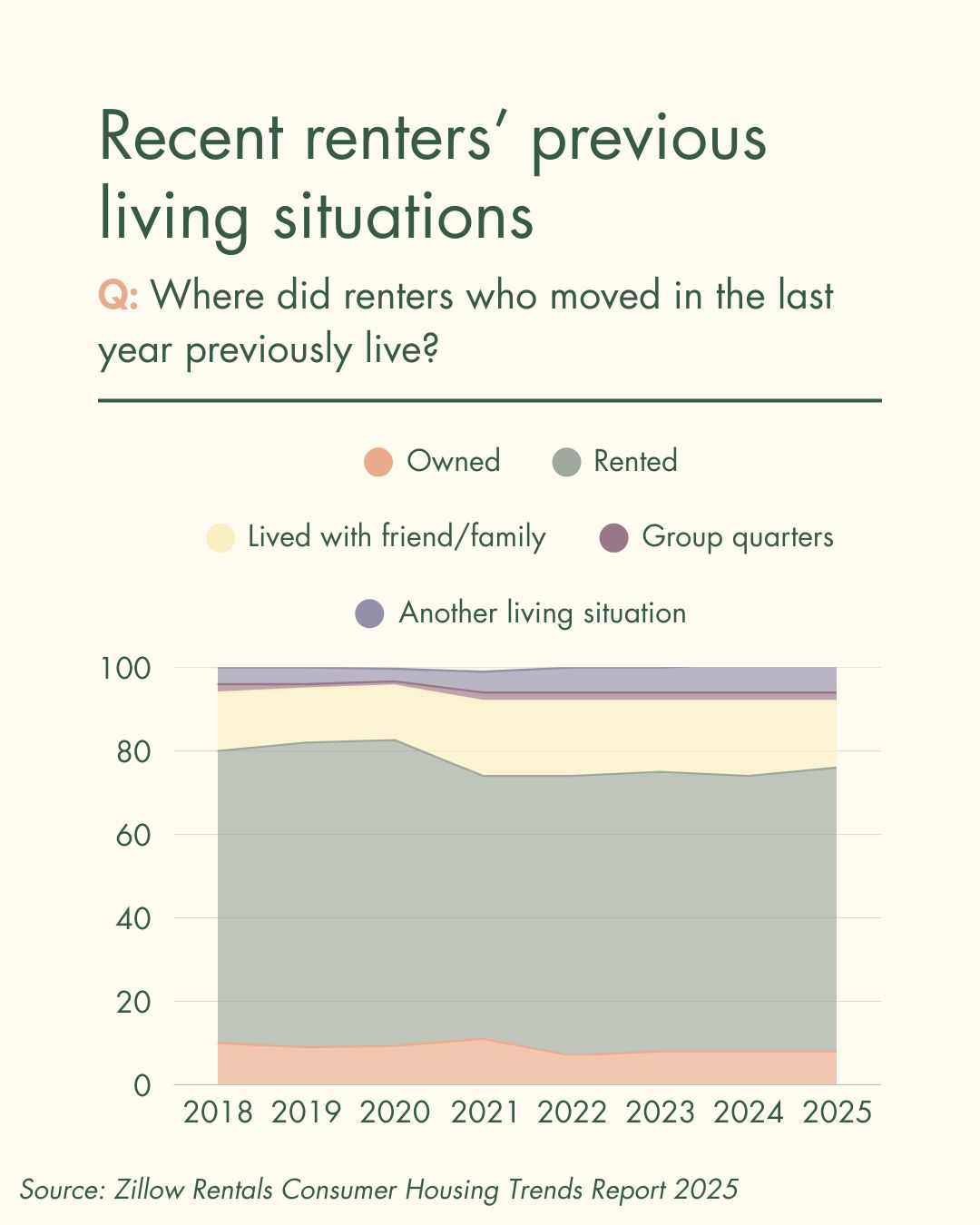

For much of Gen Z, renting is seen as an optional expense, not a necessity, with young people opting out of the market in favor of more affordable alternatives. Since 2020, a large number of new renters have reported previously living with their family or in an alternative living situation, suggesting that the pandemic could have had a sustained effect on young people’s propensity to rent. Multifamily owners are no longer just competing with each other for leases; rather, they’re competing with all of a prospects’ alternative options.

Identity Economics: A Modern Approach for Modern Renters

To better understand what influences Gen Z renters, experts are turning to identity economics, the notion that social identities work alongside traditional economic incentives to influence renters’ decisions. The modern renter is paying for more than square footage. Aesthetics, community, and lifestyle functionality matter just as much as the floor plan specs. By understanding identity economics, savvy owners and operators can better serve residents and build unique competitive advantages. Let’s look at an example.

At the NMHC Annual Meeting, we learned that 74% of Gen Z consider themselves to be content creators. While most content creators are hobbyists who need different jobs to pay their bills, content is at the core of how young people express their social identities, so they still want living spaces that accommodate their content creation needs. This shift in lifestyle preferences presents a range of opportunities for owners and operators, from low/no cost enhancements to more intensive capital expenditure.

Gig-speed internet: Beyond the basics (cost, floorplan, and location), internet accessibility is now renters’ most essential apartment feature, surpassing common building amenities like a gym or business center [RENTCAFE]. As the digital world permeates renters’ social identities, they demand apartments that offer digital connectivity.

Creator amenities: Podcast rooms, co-working spaces, and other creator-focused amenities offer a unique appeal for rental prospects. Minor enhancements to shared spaces can serve in-demand functions and help move the needle for leasing.

Digital engagement: Savvy operators should encourage and enable community engagement across digital platforms, from SMS notifications to Instagram Reels. Digital touch points offer convenience for renters and connectivity for communities, and they can be used to enhance brand visibility.

Get to Know Your Specific Audience

While industry trends and demographic data provide a high level view, it is important to remember that the modern renter is not a monolith. Each city, property, and unit has its own unique renters with their own unique needs. For operators, the challenge becomes understanding your specific prospects and renters. With the right approach and the right tools, it is possible.

Ask them. It seems simple, right? No one can tell you what your renters value better than your renters themselves. But site teams don’t have the bandwidth to survey each resident individually. Automated outreach can help you learn more about renter preferences while maintaining resident engagement.

Use your first-party data. Prospects aren’t shy about what they like or why they won’t rent. While you can’t accommodate each need individually, the data can be aggregated and turned into a powerful resource for operations, marketing, and more (learn about leveraging your first party data).

The Livsee Blog was created by Livsee’s team of experts to help multifamily owner-operators lease smarter. For insights covering proptech, AI, and innovation in multifamily, make sure to subscribe and follow Livsee on social media.

Ready to go Beyond the Conversation? Schedule a demo to see how Livsee helps properties strategically increase their occupancy.